The permanency of Incentives

You only need to observe the historical data to appreciate the role and materiality of lease incentives.

How incentives are applied and the lease terms governing each party‘s rights and obligations in respect of incentives can have a huge impact on balance sheets and a tenant’s financial standing.

The pandemic years in particular have seen a widening gap between face rents and incentives – a mechanism which has proven effective as an artificial stabiliser of reportable headline rent figures.

Understanding the role and permanence of incentives in the Australian market should fundamentally challenge and potentially shift industry thinking of valuation approach and leasing norms.

I’m not a valuer and in full disclosure the main source of my understanding of the valuation approach in this country is informed by a Property Council of Australia feasibility course I took a number of years ago.

In that course our lecturer revealed that the accepted valuation methodology is to capitalise face rents and treat incentives as a one-off deduction.

At the time I challenged the lecturer on this. The point I raised was that the above approach would be fine if an initial lease incentive was genuinely a one-off enticement to sign up a tenant. But lease incentives now represent a necessary off-set mechanism to realign the face rent back to a true effective market rent.

His response: “I understand what you’re saying but that’s the way the industry does it”.

I was then, and remain now, incredibly dissatisfied with this response.

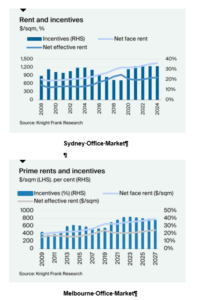

The statistics from 2019 onwards are particularly telling.

Below is an extract from report entitled “Sydney CBD Office Market, February 2023” and “Melbourne CBD Office Market, March 2023”, compliments of Knight Frank Research.

Pay particular attention to the period from 2018 to 2023. As we all know, this was a particularly difficult period for the office market with a significant spike in vacancies and challenging letting conditions.

If you believe face rents are somehow representative of market rent, think again. During this period face rents remained stable and from 2021 increased slightly. Business as usual. Nothing to see here.

Now look at incentives. Incentives went from circa 18% to 33% in Sydney, and from circa 24% to 42% in Melbourne.

Incentives are not merely an enticement to sign up a tenant, they are a structural component of the rent structure necessary to achieve the ‘true’ market rent.

Incentive clawbacks

Incentive clawbacks are a bugbear of mine. Not conceptually, but in terms of industry practices.

Most industry precedent leases contain a flawed clawback formula which only calculates a clawback correctly if the relevant incentive has been fully paid to the tenant. Where only part of the incentive has been paid to a tenant, the “industry standard” clawback formula miscalculates the clawback and overstates the amount to be repaid by a tenant.

Lawyers are experts at ripping off template documents and rebadging them. They also tend to be hopeless with numbers. I’m convinced this winning combination is how our industry has ended up with the same flawed clawback formula in every institutional lease you pick up.

There is a good chance your lease will prescribe the clawback formula along the following lines:

where:

R = I x (TR/T)

R = is the amount of the Incentive to be repaid;

I = is the amount of the Incentive then received by the Lessee pursuant to this deed;

TR = is the number of days between the date on which this Lease was terminated and the date that the Lease expires; and

T = is the number of days in the Term

It seems simple enough, and is universally accepted so it must be right!

I’ve copied and pasted this formula from an incentive deed I’ve just reviewed. The incentive amount is approximately $14 million, on a 7 year term, and permits the incentive to be taken in a number of ways including as a fitout contribution.

As commonly seen in these types of deeds, the tenant may submit incremental progress claims but the final 20% will not be released until a shopping list of requirements is satisfied including the rectification of all defects, delivery of tax deprecation schedule, as-built drawings, etc.

Contemplate this. 12 months into the term, the landlord terminates the lease. The tenant’s builder has been slow to sufficiently rectify defects so the tenant hasn’t yet managed to qualify for payment of the final 20% progress claim. The tenant elected to take $7M of the $14M as a fitout contribution. It elected to take the balance as rent reduction abated evenly over the term, which was excluded from the clawback calculation.

At the time of termination, the tenant had been paid $5.6M of the $7M allocated to fitout contribution.

As the lease has been terminated one year into the 7 year term, the tenant should only be entitled to the benefit of 1/7th of the full fitout contribution allocation (being $1M). Therefore, at the end of the first year of the term, the tenant has received the benefit of an additional $4.6M. The clawback formula should conclude that the tenant is required to repay any excess received, being $4.6M.

Spoiler alert! This is not the number the industry standard formula produces.

R = $5.6M x (2190/2555*)

= $4,799,000

* Days calculated using a 365 day year.

This calculation over-calculates the amount the tenant is required to pay by $199,000. Oops.

To be fair, if our scenario was that the tenant has received the full $7,000,000, the formula would have correctly calculated the clawback amount. But that’s the thing with formulas – they are meant to work in all scenarios, not in most.

For all those landlords and lawyers ready to copy and paste the corrected formula into their template documents (one that works for both partial and whole payment scenarios), try this:

R = I – A x B

C

where:

R is the amount of the incentive to be refunded.

I is the amount of the incentive then received by the tenant pursuant to this deed;

A is the total amount of the incentive provided for in this deed;

B is the number of days between the commencement date and the date on which the lease was ended; and

C is the number of days in the term.

Taking our earlier scenario and applying the corrected formula:

R = $5.6M – ($7M x 365/2555)

= $5.6M – $1M

= $4,600,000

Does it matter?

Of course it matters. If you are going to calculate an amount repayable for loss, then best get it right!

GWC Property Group Pty Ltd v Higginson and others [2014] QSC 264 held that the clawback mechanism operated as a penalty at law and was not enforceable. The decision was most recently affirmed by Alamdo Holdings Pty Ltd v Croc’s Franchising Pty Ltd (No 2) [2023] NSWSC 60.

In both cases the clawback provision featured the ‘standard’ formula. This is not to say that the clawback would necessarily have been enforceable if the corrected formula was substituted; however, it certainly doesn’t help a landlord’s case when the formula demonstrably over-calculates the clawback payment.

Overlay this with the recent changes to the Australian Consumer Law (‘ACL’) implementing a harsh penalty regime for breaches of the ACL for anti-competitive behaviour involving unfair contract terms.

If it is established that a lease is a “small business contract” considered to be a “standard form contract” and a court decides that a term is “unfair”, it will be void and a landlord may be required to pay damages in accordance with the punitive damages regime under the ACL.

I’ve been banging on about this issue to my counterpart solicitors (and my poor colleagues) for a long while now. Some landlords have been receptive.

Some other institutional landlords (or more precisely, their solicitors) have dug their heels in and relied on the fact that it is their client’s “standard formula and will not be changed”.

In one matter, I even prepared a worksheet for the landlord’s solicitor plugging in actual numbers into their formula to show the miscalculation. The solicitor was then a Senior Associate at a national firm (now Partner) and after following up with them, the solicitor admitted they hadn’t even read what I had circulated but regardless they didn’t agree with me.

The beauty of a formula and working calculations is that numbers are what they are. Maths is black and white. X either equals Y, or it doesn’t. If a formula can’t produce the correct number in some cases, it is a flawed formula.

As an industry, it’s time to take stock and reassess how incentives have changed the leasing and valuation landscape. Just because something is ‘standard’, doesn’t mean it is right.

Download PDF here – Lease Incentives – When ‘standard’ just won’t do

Speirs Ryan is a Sydney and Melbourne based boutique property law firm with national coverage. The firm is uniquely placed with specialist teams in both property transactions and strata law.

Disclaimer: This article is a general summary with focus on issues of interest to the authors. It is not intended to be used as legal advice.